Customer reports

Use these reports to keep track of your customer accounts and their associated transactions. The following reports are accessed from Customers > Customer Reports.

Tip: You can also track sales by using customer enquiries and customer statements, which are accessed from Customers > Credit Control > Run Customer Statements.

Account Analysis

| Report | Description |

|---|---|

|

Use this report to provide details of customer transactions posted, for either a single posting date or a range of dates. The posting date is the physical posting date of the transaction; the system date on which the transaction was entered, not the date entered for the transaction itself. Therefore you can report on all entries that were made on a particular day. If you enter customer transactions from the Cash Book, for example, and they are held in the posting file for update to the ledger, the posting date is the date they were entered into the posting file and not the date they were posted to the customer's account. You can use this report to identify a group of transactions entered by a particular user. |

|

|

This report lists all or a selection of your customer accounts, depending on the criteria you select when preparing the report. Use this report to identify your customers. |

|

|

This lists the main account details for each customer, for example, contact details, payment terms, turnover and balance. Use the Account Details report to provide full details of your customer records. |

|

|

Transaction Listing (by Period) Transaction Listing (Online) |

This report lists current transactions on the ledger in the range you specify for the report. You can specify current transactions, transactions by period or online payment processing transactions. Transactions are grouped by customer and displayed in the order in which they were added. The report also provides totals showing values for each goods, VAT, discount, allocated and outstanding amounts. |

| This report lists transactions which involve VAT and have been added during the current period. Specify the number of VAT months over which transactions are to be included. As a result of this only transactions up to 300 days old calculated from the current system date will be included. Use the information in the printed report to reconcile with your VAT Return transactions for the same VAT period. | |

|

Trading Report (Summary) |

Use the Trading Report to determine the level of trading activity between you and your customers. From this report you can identify the customers who spend most money. By comparing this report to the List of Accounts report you can identify those customers who have not traded with you for some time. The Trading Report can be prepared in a detailed or a summarised format. The detailed report displays the turnover for the current year and last year for each customer on the ledger. It also details the turnover figures for the current month and the last six months of trading for each customer. Details of future transactions which may have been posted for a customer are also included. The summarised report displays the turnover for the current year for each customer together with the customer's account balance and the date the last transaction was applied to the account. |

|

If you are registered for VAT and supply goods to customers in the EU you need to submit:

This report lets you output the EC Sales List or VIES return as an XML file which you can upload directly to the HMRC or Irish Revenue website. For more detailed information about the procedure for producing the EC Sales List, see Produce your EC Sales List (ESL) or VIES return. |

|

|

RCSL Report (Summary) Produce RCSL Declaration |

From July 2022, you are no longer to submit your Reverse Charge Sales List to HMRC. However, you can still produce the Reverse Charge Sales List reports or CSV file for your own use. You would record reverse charge sales if you're accounting for VAT as a domestic reverse charge to prevent fraud in trade between businesses within the UK centres. This is known as carousel fraud or missing trader intra community (MTIC) fraud. For more detailed information about the RCSL, see Reverse charge VAT to prevent carousel fraud (UK). |

|

You can produce mailing labels to use when you issue statements and letters to your customers. This prints an address label for each customer account. |

|

| Accounts not active | Use this to check which customer accounts are hidden and who changed their status. |

| Customers with no transactions from |

Use this to find customer accounts that you have not traded with for a long time. This can be useful to find old accounts that you might be able to delete. See Managing your contact information (GDPR). |

|

Invoice Payments Transactions Invoice Payments Transactions (Refunds) |

Use these reports to show a list of payments or refunds from Invoice Payments. Transactions are grouped by currency and the customer account. The reports also show outstanding transactions that have not been allocated to an invoice. |

Credit Control

| Report | Description | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

Aged Debtors (Summary) Aged Debtors (Unallocated Cash) |

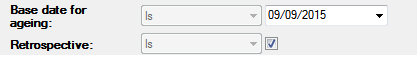

These reports let you analyse trends in customer payments, identifying customers whose payments are overdue. You can also use the Aged Debtors report to reconcile your sales with the nominal postings. The reports show outstanding balances on each account and the age of the transactions. These are aged using the transaction date, the due date, or the accounting period, depending on your Ageing setting in Settings > Customers and Suppliers > Customer Defaults and Settings | Processing. See Ageing your transactions. Tip: The ageing periods (e.g. 30 days, 60 days) used on statements and in aged debtors reports are specified in Settings > Customers and Suppliers > Customer Defaults and Settings | Ageing. You can also produce the aged debtors reports for selected dates in the past. To do this, you must select Retrospective on the report criteria. The aged debt report that is produced is for the Base date for ageing date entered. Invoices paid after this debt are shown as not paid. Receipts allocated after this date are shown in the report as if they have not been allocated. How are transactions shown on the aged debtors reports?

The following table shows how invoices entered and paid on different dates are shown on the aged debtors reports.

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Due Date (Summary) |

This report presents information about the outstanding balances on each customer account, using the due date of the transactions. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| This report shows the time taken to pay the sales invoice. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Debtor Letters |

You can produce letters to send to customers with outstanding debts. For more information about this, see Set up debtor (chase) letter templates. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Chase Debt |

Use the Note: The Follow-up date in the report shows the earliest Follow-up date that can be found in all your live communications with this Open: Customers > Customer Reports > Credit Control > Chase Debt |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Optional additional reports

These reports are available to download and install using the Custom Report Manager. See Install additional reports with the Custom Report Manager.

| Report | Description |

|---|---|

| Top Customer List - YTD | Shows the turnover for the year to date for each customer. Use this to find who your top performing customers are. |

| Customer Sales by Product Group (Summary) | Shows the information about sales made to each customer by product group. The invoices, credit notes, quantity and net value are totalled for all items per product group. |

| Customer Credit Limit and Balance | The credit limit and balance to date for each customer. |

| Customers On Hold | Shows the customers whose accounts are hold. |

| Customer Receipts Day Book | Lists customer receipts by bank account. |

| Customer Day Book | Lists invoices and credit notes by customer |

Sage is providing this article for organisations to use for general guidance. Sage works hard to ensure the information is correct at the time of publication and strives to keep all supplied information up-to-date and accurate, but makes no representations or warranties of any kind—express or implied—about the ongoing accuracy, reliability, suitability, or completeness of the information provided.

The information contained within this article is not intended to be a substitute for professional advice. Sage assumes no responsibility for any action taken on the basis of the article. Any reliance you place on the information contained within the article is at your own risk. In using the article, you agree that Sage is not liable for any loss or damage whatsoever, including without limitation, any direct, indirect, consequential or incidental loss or damage, arising out of, or in connection with, the use of this information.